US Assisted Living Costs by State

Over 49 million people in the United States are aged 65 and over, representing over 15 percent of the population. 1.6 percent of seniors live in an assisted living facility, enjoying the freedom of their own space but with added care and assistance.

The cost of this type of care varies depending on a number of factors, including the level of care and size of the facility, but the location is also a huge indicator as to how much you can expect to pay.

So, how much does assisted living cost in your state?

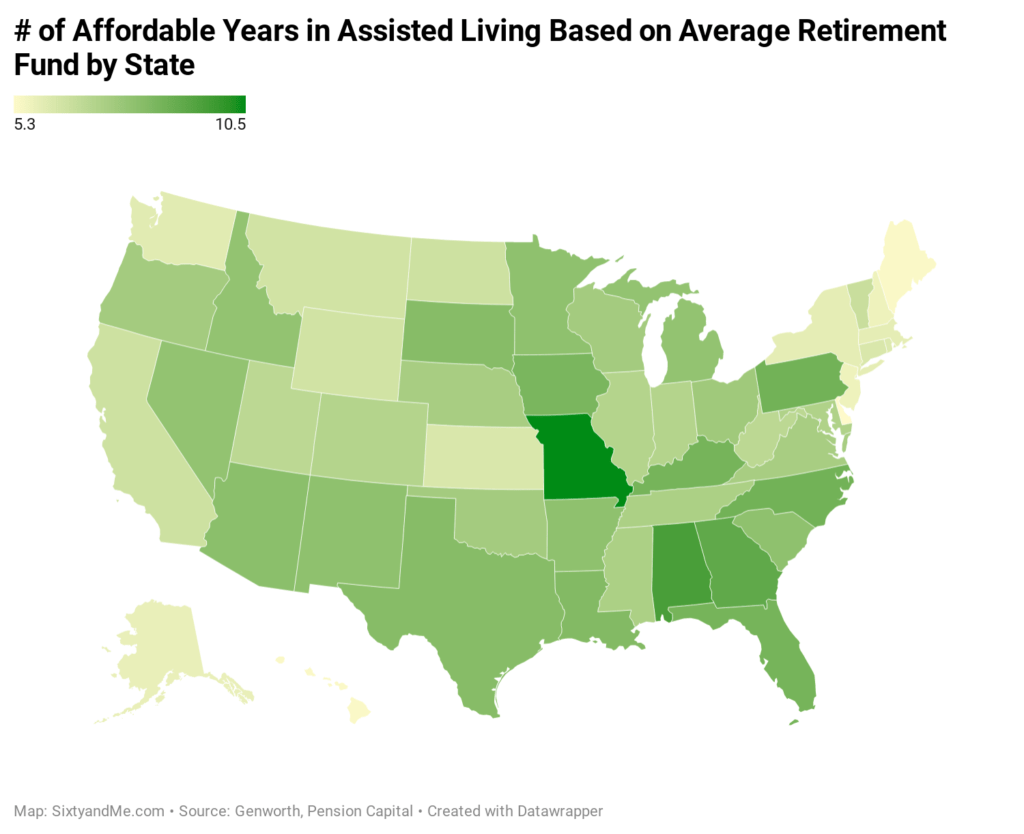

We combined Genworth’s Cost of Care Survey with other datasets to create an assisted living index based on the average cost and retirement fund by state.

Assisted Living Index: In Which State Will Your Retirement Fund Go Furthest?

Nationally, the average cost of assisted living facilities per year is $51,600 and the average retirement fund (according to Pension Capital) is just over $382,000. This means the average American has enough funding for around six years in an assisted living facility*.

With studies indicating that the average person spends nearly 2.5 years (29 months) in an assisted living facility, it may seem as though there’s ample funding (even in least-cost-effective Delaware there are enough funds for over 5 years). Yet, when you factor in that the average person also spends approximately 2 years and 4 months in a nursing home (where the national annual cost is $93,075 for a semi-private room and $105,850 for a private room) this means that the average person requires from around $342,000 to $372,000 to cover their long-term care costs.

And, as the below chart demonstrates, there tends to be a correlation between where the highest retirement funds are and where the highest assisted living costs are.

In Connecticut, for example, retirees have an average retirement fund of over $471,000 but the annual cost of assisted living is $75,600 (the fourth-highest in the US).

The state with the best deal appears to be Missouri where an average retirement fund of $377,600 gets you 10 and a half years’ worth of assisted living at an annual cost of $36,000 (the cheapest in all of the US).

The Cost of Assisted Living Facilities in Each State

With over $40,000 difference in the annual assisted living cost between the cheapest and most expensive states, being clued up on the cost of long-term care where you live can help you and your family prepare for your future.

Top 5 Cheapest States for Assisted Living

- Missouri – Annual Cost of $36,000: In Missouri, those opting for assisted living can expect to pay around 35 percent less than the national cost, saving over $15,500 compared to the average person and over half of what those in Delaware pay.

- Alabama – Annual Cost of $37,800: Almost $14,000 cheaper than the national annual cost, assisted living homes in Alabama can be around 31 percent cheaper than average.

- Utah – Annual Cost of $40,800: By choosing an assisted living facility in Utah, you could save nearly 24 percent, which equates to around $10,800.

- Arkansas and Georgia – Annual Cost of $42,000: Arkansas and Georgia tie in fourth place with an average cost that’s 20.5 percent ($9,600) cheaper than the national average.

- Nevada – Annual Cost of $43,140: Nearly 18 percent ($8,460) cheaper than the national average, assisted living facilities in Nevada are the fifth-cheapest in the United States.

Top 5 Most Expensive States for Assisted Living

- Delaware – Annual Cost of $80,280: At a cost of more than $80,000, assisted living facilities in Delaware could set you back over $28,000 more than the national average. You can also expect to pay more than double what those in the cheapest state, Missouri, pay ($36,000).

- New Jersey and New Hampshire – Annual Cost of $79,800: Residents in New Jersey and New Hampshire should anticipate assisted living costs that are 43 percent more than the national average, costing $28,200 more.

- Alaska – Annual Cost of $79,590: 42 percent ($28,000) more than the national average, Alaskans pay almost $80,000 for assisted living facilities per year.

- Connecticut – Annual Cost of $75,600: If you opt for an assisted living facility in Connecticut, the costs could be over 37 percent more ($24,000) than average.

- Massachusetts – Annual Cost of $73,020: $21,000 more than average, assisted living facilities in Massachusetts are around 35 percent more expensive.

Choosing an Assisted Living Facility

While the cost may be a huge consideration for your choice of assisted living facility, there are a number of other things you may want to consider too. These include:

- Location: Even though Missouri may have the cheapest assisted living facilities, these won’t be of much use to you if your family and friends live in Washington. You should also look into the laws surrounding assisted living in your state. This is because some laws limit the medical assistance these facilities can offer. So, if you’re in need of a certain level of care, these homes might not be right for you and your health.

- Services: Many facilities will provide all of the essentials like housekeeping, fitness programs, medication support, and dining services. However, some may also offer tailored services that are more suited to your individual needs. This could be a program related to heart health or on-hand specialists in Alzheimer’s and dementia.

- Size: Some assisted living facilities may only have a handful of beds while others may have hundreds. A smaller, quieter facility may suit you if you enjoy your own company, while social butterflies may prefer the hustle and bustle of larger ones. Larger facilities are more likely to have more amenities, like swimming pools, gyms, and cinemas, too. Another thing to consider is the ratio of residents to staff. Are there enough staff members on hand to offer the right level of care for you?

- Future Care: Even though the thought of moving into an assisted living facility after having full independence is a huge step in itself, thinking even further ahead is a good idea. Assisted living might not be suitable forever, so what, if any, higher level of care does your chosen location offer? What are the costs for these?

Choosing an assisted living facility is a very personal choice. So while the above factors will play a huge role in your choice, so too should your own gut feeling and happiness. Be sure to visit a shortlist of potential places to get a good feel for them. Do you feel as though the staff is there because working with seniors is their passion? Or, are they simply getting through the day for their paycheck?

Chat to fellow residents, attend a class, share a mealtime there, and see if the environment feels right for you or your loved one.

Paying for an Assisted Living Facility

The average national cost for an assisted living facility rose by 6.15 percent from 2019 to 2020. But in some states, the cost rose significantly more (29.1 percent in Connecticut, for example). Knowing how far your finances will go and how you can fund this next stage in your life is crucial.

Here are some of the ways you may fund assisted living:

- Personal Funds: For many, the initial idea of paying for long-term care with their private savings seems the best way forward. However, as we have seen, costs for these facilities are high – and they’re rising. Over time, your personal investments, i.e. your 401(k), may not stretch far enough to cover these costs.

- Insurance: In order to preserve your savings for the future and/or for your loved ones, an insurance package may be the better option. They can help make up the monthly installments for your care and may give you access to more services. Be sure to look into your existing policy to see exactly what it covers as they can vary dramatically.

- Medicare and Medicaid: Medicare will not cover the costs for long-term care, but Medicaid is available for those who qualify for government aid due to low income or those who have already exhausted their own funds. The type of funds available can also vary by state and not every assisted living facility will participate.

- Reverse Mortgage: If you’ve built up equity on your property, reversing the mortgage on it can give you access to the money you need for your care. The money is repaid when you (or your partner) leave the home. This is a great option for those who need assisted living for one person but it may not be the best choice if you don’t wish to sell the property eventually.

- Veterans’ Benefits: The Veterans’ Administration (VA) offers some level of benefits to those who have served the country. Known as Aid and Attendance, the amount you receive depends on whether you are married. Veterans with no dependents may receive $1,936.50 per month, while veterans with at least one dependent may receive $2,295.75 per month.

*We appreciate 100% of a person’s retirement fund is highly unlikely to go on assisted living/care costs, but this is to give an example of how far funds may go.